December 15, 2022

Donor-Advised Funds Combine Charitable Impact with Tax Benefits

A donor-advised fund (DAF) is a charitable account offered by sponsors such as financial institutions, community foundations, universities, and fraternal or religious organizations. Donors who itemize deductions on their federal income tax returns can write off DAF contributions in the year they are made, then gift funds later to the charities they want to support. DAF contributions are irrevocable, which means the donor gives the sponsor legal control while retaining advisory privileges with respect to the distribution of funds and the investment of assets.

Donors can take their time vetting unfamiliar charities and exploring philanthropic opportunities. They can wait to take advantage of matching fund campaigns, have money ready to aid victims when disaster strikes, or build up funds over multiple years to make one large grant for a special purpose. Grants can generally be made to any qualified tax-exempt charitable organization in good standing.

Under current law, there are no rules about how quickly money in DAFs should be granted. However, legislation has been introduced — the Accelerating Charitable Efforts (ACE) Act — that would impose a 15-year limit on the donor’s advisory privileges, among other changes. You may want to watch for future developments if you are interested in using donor-advised funds to execute a charitable giving strategy. (Any legislation passed in 2022 likely would not take effect until 2023.)

Tax-Efficient Timing

Gifts to public charities, including donor-advised funds, are tax deductible up to 60% of adjusted gross income (AGI) for cash contributions and 30% of AGI for non-cash assets (if held for more than one year). Contribution amounts that exceed these limits may be carried over for up to five tax years.

DAF contributions can be timed to make the most of the tax deduction. In an especially high-income year, for example, a larger contribution might keep a taxpayer from climbing into a higher tax bracket or crossing a threshold that would trigger Medicare surcharges or the net investment income tax.

Now that the standard deduction has been expanded ($12,950 for single filers and $25,900 for joint filers in 2022), many taxpayers don’t benefit from itemizing deductions, including those for charitable donations. But with advance planning, it may be possible to bunch charitable contributions that would normally be donated over several years in a single tax year, ensuring that itemized deductions surpass the standard deduction.

A similar approach may appeal to pre-retirees in their peak earning years. Those who expect to be in a lower tax bracket and/or might claim the standard deduction during retirement might consider making deductible contributions to a donor-advised fund while they are still working.

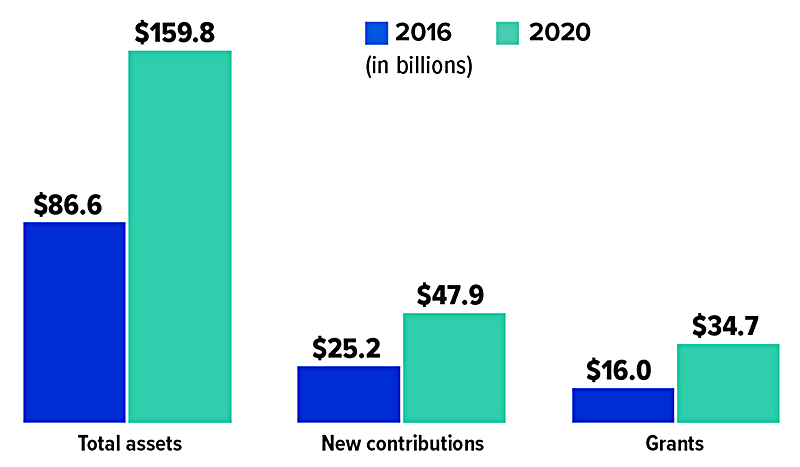

Growth in Donor-Advised Funds

Contributions to DAFs accounted for about 10.1% of total U.S. charitable giving in 2020.

Gifting Appreciated Assets

Contributions to a donor-advised fund can be made with cash, publicly traded securities, and more complicated assets such as real estate, valuable art and collectibles, or a stake in a privately held business, offering a convenient way to gift appreciated assets. Fund sponsors typically have experience in evaluating and liquidating donated assets (a qualified appraisal may be needed). This way, a donor can make a single contribution to a DAF that eventually benefits multiple charities, including smaller organizations that are not able to accept direct donations of appreciated assets.

Giving appreciated assets to charity can provide lucrative tax savings. A donor may qualify for a tax deduction based on the current fair market value of the contribution while helping reduce capital gain taxes on the profits from the sale of those assets. This strategy may be helpful when family businesses or shares of privately held companies are sold, or any time a larger tax deduction is needed.