December 9, 2022

Retirement Savings in a Volatile Market

If you worry about your retirement investments during market downturns, you’re not alone. Unfortunately, emotions are often the enemy of sound investing. Here are some points to help you stay clear-headed during periods of market volatility.

Markets Rebound

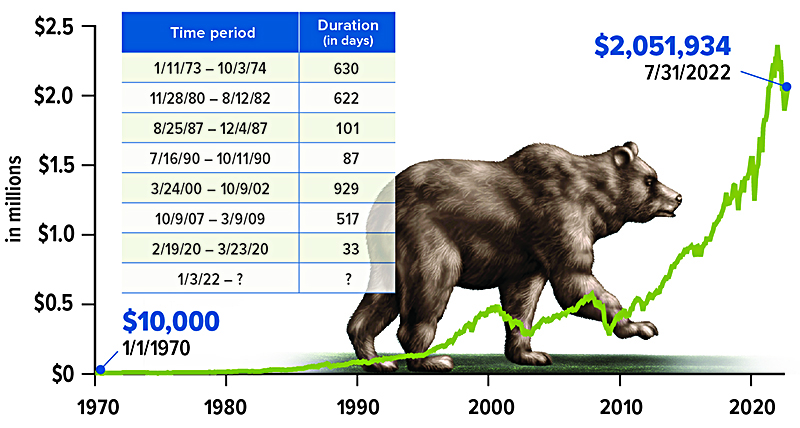

Historically, even the worst bear market has bounced back and eventually gone on to reach new highs. In fact, since 1970, bear markets have lasted an average of 14 months.

A Chance to Buy Low

If you’re investing a set amount of money on a regular basis, such as in a retirement plan account, you’re buying fewer shares when prices are high and more shares when prices are low — one of the basic tenets of investing wisely.

Systematic investing involves making continuous investments on a regular basis, regardless of fluctuating share prices. Although this strategy does not ensure a profit or prevent a loss, you must be financially able to continue making purchases through extended periods of high and low price levels.

Retiree Strategies

The risk of experiencing poor investment returns just before or in the early years of retirement is a significant factor that can affect a nest egg’s long-term sustainability. Fortunately, some strategies can help mitigate this risk.

For example, consider a tiered investment strategy, in which you divide your portfolio into tiers representing your short-, medium-, and long-term needs for income and growth.

The short-term tier(s) could contain the amount you need for about two to five years, invested in assets designed to preserve value. The medium-term tier(s) could hold investments that strive to provide income for perhaps three to 10 years, balanced with some growth potential. The longer-term tier(s) could hold higher-risk, higher-growth potential assets that you wouldn’t need for at least 10 years. Generally, this tier is intended to feed the shorter-term tiers and fuel the strategy over the course of your retirement.

Another possible strategy is using a portion of your retirement savings to purchase an immediate annuity, which offers a predictable retirement income stream you could pair with Social Security and any other steady income sources to cover your fixed expenses.

An immediate annuity is an insurance-based contract in which you pay the issuer a single lump sum in exchange for the issuer’s guarantee of regular income payments for a fixed period or the rest of your life. With some exceptions, you typically receive fixed payments with little or no variation in the amount or timing. When purchasing an immediate annuity, you relinquish control over the amount you invest.

A Financial Professional Can Help

If volatile markets prompt you to question your retirement investing strategy, your financial professional can be an objective third party to help ease your worries and evaluate possible portfolio shifts.

Bear Markets Eventually End

A bear market is generally defined as a loss of at least 20% from a recent high. From 1970 to 2021, there were seven bear markets, the longest lasting less than three years. A new bear market began in January 2022. Despite these down periods, a hypothetical $10,000 investment in the S&P 500 in 1970 would have grown to more than $2 million by 2022.